Alex: I am curious to know about the credit card transaction. I just go to a shop, swipe my card and everything happens in less than a minute. Wow….amazing right?

Rico: Yes you are right; it is one of the most intelligent creations of mankind and offcourse complex architecture.

Alex: Which was the first credit card?

Rico: Diner’s card, during early 1950’s.

Alex: OMG….i didn’t know about that…

Rico: since its introduction into the world market, electronic commerce has undergone numerous enhancements and the evolution was phenomenal.

Alex: Electronic commerce? Are you talking about Credit card?

Rico: oh well…Electronic commerce cards are Debit, credit, prepaid….etc

Alex: Who are the main stakeholders of a transaction?

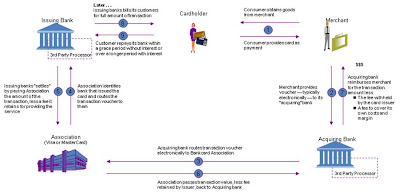

Rico: Basically five major stakeholders are involved. They are Associations (Visa or MasterCard), Issuer, Acquirer, Merchant and Cardholder.

Alex: Who is cardholder?

Rico: Well, it is the customer who holds a valid credit card issued by some banks.

Alex: What is the role of an Issuer and an Acquirer?

Rico: Issuer is the bank which issues the credit card, where us the Acquirer is the bank which holds the POS machine or the bank of the merchant.

Alex: What is POS machine?

Rico: It is Point of Sale, the machine used to swipe the card. It is issued by the bank which the merchant hires. There are third party processors which provides POS machine as part of their services.

Alex: Can the issuer and acquirer be the same banks?

Rico: Off course, both can be same or not. Some countries have restrictions like in Canada.

Alex: Associations?

Rico: Yes, They are non-profit organizations which provide medium/channels between banks for speedy transactions. The revenue they yield is utilized for the technology enhancements and the employee benefits.

Alex: How will be the Visa and MasterCard benefited?

Rico: Visa and MasterCard charges every transaction which happens through their network, a small service charge.

Alex: How exactly is the transaction happens?

Rico: The time when the Cardholder swipes the card in a POS machine, it undergoes a cycle of processes starting from authorization until billing.

Alex: Who are processers?

Rico: Ah!!! They are third party vendors or processors, who help the banks in transactions. They do authorization, billing, report generation with the help of Visa and MasterCard channels.

Alex: How does the Merchant receives money?

Rico: There are applications which pull the merchant files and the files are fed into batch jobs (which run during the night). After successful batch run the merchants will receives the money. Also, some service charges are deducted from the merchants for using POS machine.

Alex: you mean to say that merchants will not receive money when a customer swipes the card???

Rico: No, merchant will receive only after the successful batch run.

Alex: Rico, lets continue the topic some other time…I need to push off now……

No comments:

Post a Comment